Pulling back the curtain on the magic of Y Combinator

A first-of-its-kind deep dive into the data to see what’s really working for the industry’s biggest incubator

Hey everyone, I just did a deep dive on YC with Lenny Rachitsky’s Lenny's Newsletter and I’m really excited to share a bit of it with you here.

✨ Here’s the intro (full article is here):

Y Combinator (YC) is widely regarded as the most successful startup accelerator and the top choice for world-class entrepreneurs. For those new to the startup world, Y Combinator is like a boot camp for startups. Selected founders receive $500,000 in seed funding in exchange for 7% equity. Four times a year, founders are immersed in a three-month cohort, or “batch,” with about 125 other startups, which are sorted into groups and mentored by successful founders. It’s an exclusive program—with an approximately 1% acceptance rate—offering founders a powerful network, future funding opportunities, and instant credibility.

The evidence is clear. Roughly 4.5% of YC companies become unicorns (in contrast to the 2.5% outcome for other venture-backed seed-stage startups), and around 45% of companies go on to raise a Series A (higher than the 33% average). So far, YC has funded more than 90 billion-dollar companies. Top YC companies include Stripe, Airbnb, Coinbase and Reddit.

But what does the data really say about the impact of YC and the success of their bets? We tried to demystify the giant by reviewing the 4,939 YC companies so that startup founders, investors, and others can see what’s really going on—and maybe learn from the successes or trends.

There was a lot that was surprising in the data. But one theme throughout was that the magic of the incubator appears to be in picking the best founders, understanding trends and the process within YC, not about repeating the successes of one particular startup profile. Read on to learn more about what we uncovered.

Key takeaways

YC has gone from being a Consumer investor to primarily a B2B investor. Consumer companies have resulted in over $200 billion of market cap, while B2B companies are currently privately valued at some $170 billion and are on the rise.

Based on batch profiles, founders are betting on AI (specifically, B2B AI) to be the next big thing. The most promising subcategories include “Engineering, Product, and Design,” Infrastructure, and Sales.

Solo founders are at a disadvantage. Although solo founders are encouraged, the data does show a steep decline in the number of them accepted to YC.

Success has so far been driven by U.S.-founded companies. More than 70% of the startups have been founded in the U.S., and to date, 99% of returns have come from the U.S.

The durability of YC companies is significantly higher than that of the average startup. More than 50% of companies are still alive after 10 years (vs. 30% average).

The chances of startup success are higher with YC. 45% secure Series A (vs. 33% average), 4% to 5% become a unicorn (vs. 2.5% average), and 10% achieve an exit.

The VC power law also exists at YC. Four companies account for more than 85% of YC’s returns to date: Airbnb, Coinbase, Reddit, and Instacart.

The investors in YC companies are the “crème de la crème.” Tier 1 VCs frequently invest in YC companies, and some have made several hundreds of investments.

Methodology

Sources: Y Combinator, Harmonic, and Crunchbase.

Included 4,939 YC startups from the first batch in 2005 (S05) to the fall batch of 2024 (F24). The one-off education focused batch (IK12) not included.

Not considering YC continuity investments.

Data is as of December 10, 2024 (or otherwise, as stated on the graphs).

Some companies do not disclose valuation or acquisition price, so sometimes, the data will not contain all companies. Treat the numbers below as directional, not as exact figures.

What does YC success look like?

Around 10% of YC companies achieve an exit

As of today, 17 companies have been backed by YC and gone public. Another 76% are still actively pursuing an exit. But one impressive fact is that only 13% of companies have gone out of business.

More than 50% of companies are still active after 10 years

YC companies are more durable than other startups, which have an average lifetime of around five years. Batch W15, which is now 10 years old, still has more than 50% of its companies actively operating. All other batches since then have more than 50% of companies still operating.

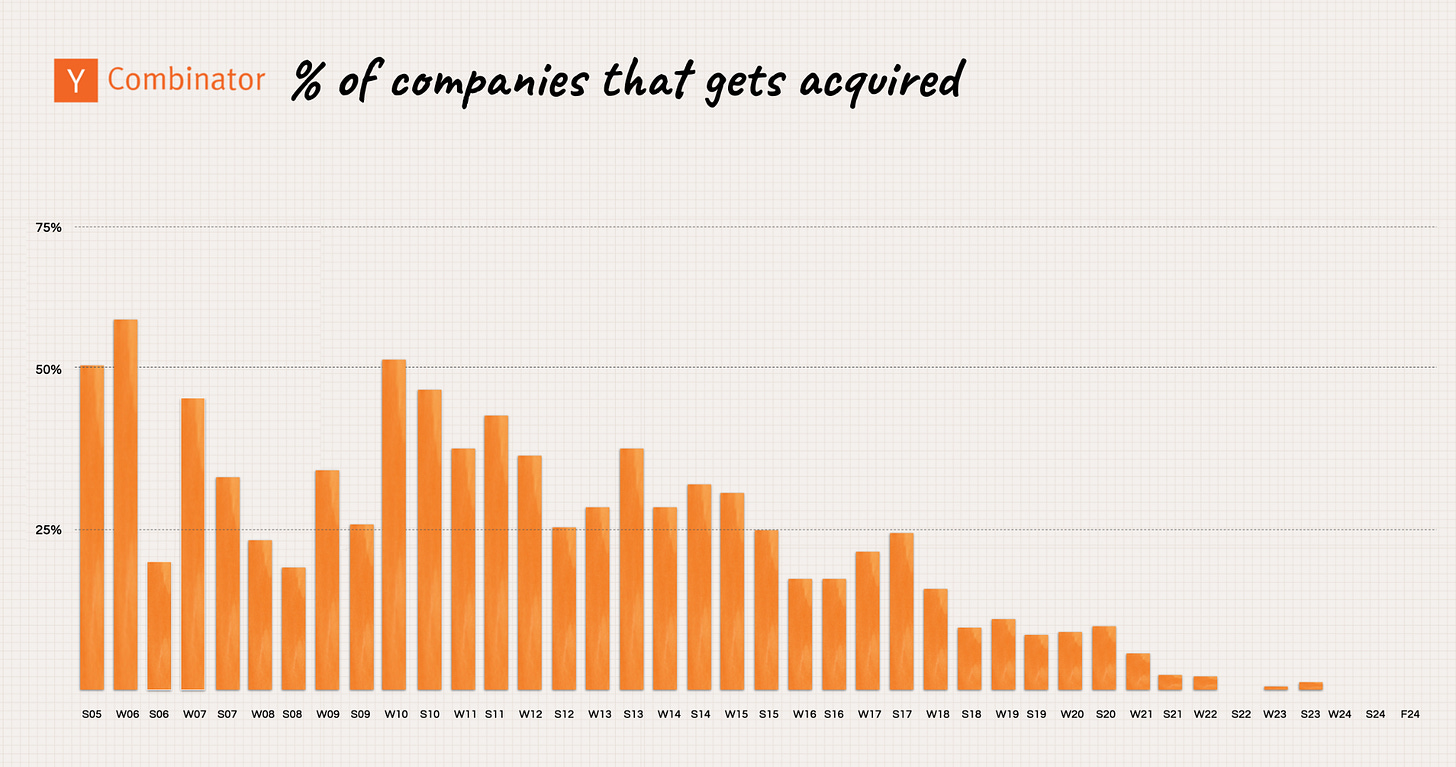

Between 25% and 50% of companies get acquired after 10 years

A measure of success for any incubator or investor is the number of companies that achieve a liquidity event, either via an IPO or an acquisition. And no one does that better than YC. When you look at the mature batches, we are seeing between 25% and 50% of companies getting acquired. This speaks volumes about the quality of companies in YC. This is in contrast to the 15% of global companies that get acquired if they have raised at least one round of funding.

What are the biggest YC winners?

Consumer companies have driven the majority of YC returns

By far the largest wins for YC have come through some of their early consumer-focused companies. As a matter of fact, the five companies with the highest market capitalization are consumer companies: Airbnb, Coinbase, DoorDash, Reddit, and Instacart. It’s no secret that technology startup outcomes follow a power law distribution, and that is also very much the case for YC, where the top four companies—Airbnb, DoorDash, Coinbase, and Reddit—account for more than 85% of the market value created.

More than $600 billion has been created in market value

YC companies attract a lot of funding. In total, more than $145 billion has flowed into the startups that were part of YC. This investment has led to the creation of more than $300 billion in market value, and with the existing private companies, this amount could double to more than $600 billion in the future (once private companies exit). Although acquisitions are the most common path for YC startups, they have “only” brought in $15 billion.

Ready to dive in? Here is the full deep-dive