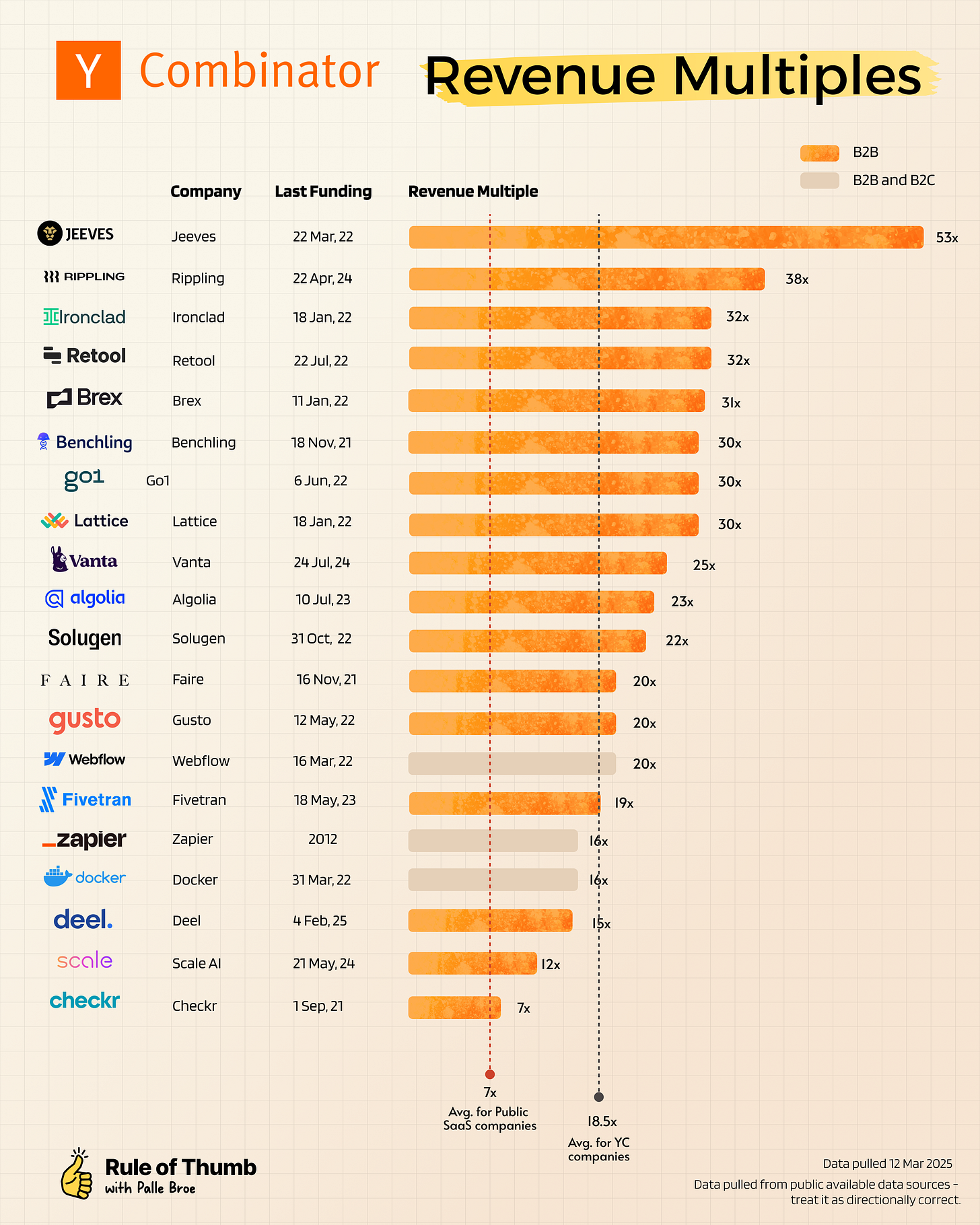

The YC Premium: Revenue multiples from the 20 most valuable private YC startups

Including: Rippling, Ironclad, Scale AI and 17 more

👋 Hi, it’s Palle Broe and welcome to Rule of Thumb, my weekly newsletter exploring the startup and tech world providing tangible advice and insights from the worlds best operators and startups

In a recent post I looked at the revenue multiples of the fastest growing AI startups which made me wonder - how does the most valuable private YC companies compare?

The answer is clear: Current AI revenue multiples significantly surpasses those of the fastest growing YC companies.

At the top of the YC range we have:

Jeeves which raised $180M at a $2.1B valuation (53x revenue multiple).

Rippling which raised $870M at a $13.4B valuation (38x revenue multiple).

Ironclad which raised $150M at a $3.2B valuation (32x revenue multiple).

At the bottom of the range we have:

Deel at 15x revenue multiple.

Scale AI at 12x revenue multiple.

Checkr at 7x revenue multiple.

On average the revenue multiple for the 20 YC companies is around 18.5x which is in contrast to the 47x average for AI companies and the average public SaaS company valued at roughly 7x their revenue today.

Data is pulled from public available sources - treat it as directionally correct.

YC Startups: Revenue Multiples

There are 2 points worth noting:

YC Companies comes with a premium. YC startups are some of the most competitive deals for a reason - they have the best founders and have shown a tremendous track record (more details here). This comes with a premium when it comes to valuations which is reflected in high revenue multiples.

B2B companies dominates. Many of the best founders today are tackling huge B2B opportunities which is also reflected in the overview here. All 20 companies are selling to businesses with only 3 also having a consumer product.

YC startups: Annual Revenue

As a point of reference I have attached the revenue from the above startups

For comparison the AI revenue multiples can be found below:

Hope you enjoyed this mini deep-dive. Please don’t forget to subscribe for more similar deep-dives in the future!

super insightful!